If your car has been in an accident and repaired, there’s a good chance it’s worth less than it was before the crash, even if it looks perfect.

This drop in resale or trade-in value is called diminished value, and the good news is that you may be able to recover this loss if the at-fault driver is insured by Allstate or you qualify under your own Allstate policy.

In this guide, learn how to file a diminished value claim with Allstate in a friendly, easy-to-understand way that helps you get the best possible outcome.

What a Diminished Value Claim Actually Means

A diminished value claim is basically a request asking Allstate to compensate you for the difference between your car’s pre-accident value and its value after repairs.

Even when repairs are done well, dealers and buyers treat “accident history” as a red flag, so they offer less. That “less” is your diminished value.

There are three kinds of diminished value, but the most common one is inherent diminished value, which happens simply because the car now has an accident on its record.

Even high-quality repairs cannot erase that. Repair-related diminished value happens when the repairs were flawed, like mismatched paint or visible panel work.

Immediate diminished value refers to the drop in value right after the accident and before repairs, although this version isn’t usually used in insurance claims.

For Allstate, you’re almost always dealing with inherent diminished value.

Does Allstate Even Pay for Diminished Value?

Yes, Allstate does pay diminished value claims, but only when specific conditions are met. In most cases, you need to be not at fault for the accident, and Allstate must cover the person who hit you.

You also need a car that still has a meaningful market value, usually a newer model with reasonable mileage.

The damage should be significant enough to lower the resale value, and you must be able to show proof that your vehicle lost value even after repairs.

If your state allows it, you may even be able to file a diminished value claim under your own Allstate policy if the at-fault driver wasn’t insured or didn’t have enough coverage.

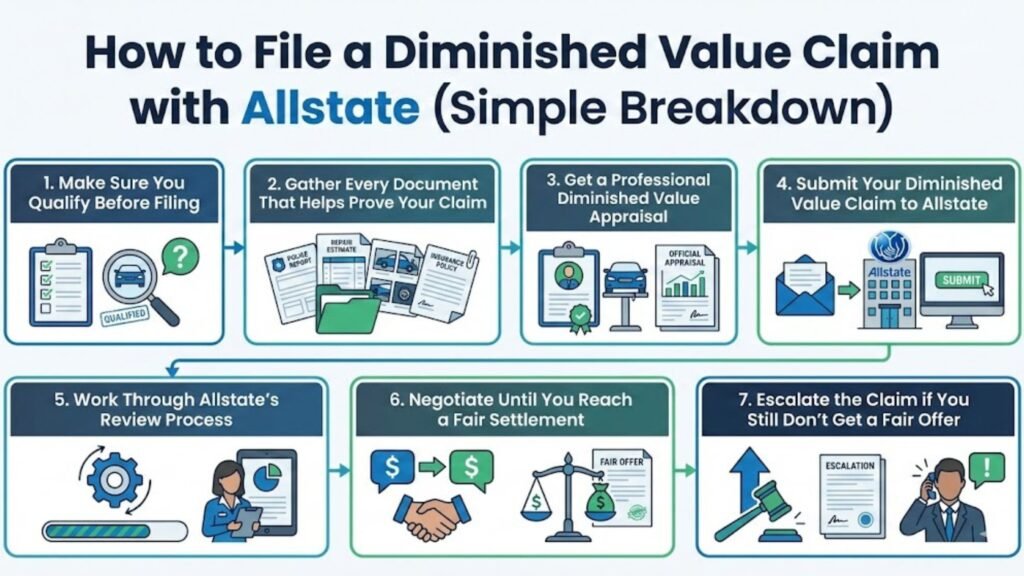

How to File a Diminished Value Claim with Allstate

Let’s walk through everything step by step so you can submit your claim confidently.

1. Make Sure You Qualify Before Filing

Start by checking your eligibility. If you weren’t at fault, and the driver who caused the accident is insured by Allstate, you’re probably off to a good start.

Then consider your vehicle’s age, mileage, and value. Newer and well-maintained cars have a much stronger chance of getting a worthwhile payout than older, high-mileage vehicles.

You’ll also want to confirm that your state allows diminished value claims, because every state has its own rules.

2. Gather Every Document That Helps Prove Your Claim

Documentation is everything in a diminished value claim. You’ll need the accident or police report, clear photos of the damage before the repairs were done, and additional photos of the vehicle after the repairs are complete.

Make sure you have the repair estimate, the final invoice, and any records that show your vehicle’s mileage or condition before the accident.

It also helps to keep screenshots or links to comparable vehicle listings that show what similar accident-free cars are selling for.

The more proof you have, the easier it becomes to show that your car lost value.

3. Get a Professional Diminished Value Appraisal

If you want Allstate to take your claim seriously, a professional diminished value appraisal is essential.

A certified appraiser will review your repair history, inspect your vehicle, compare market listings, and calculate your car’s pre-accident and post-repair value.

This creates a detailed report that clearly shows how much value your vehicle lost.

This step matters because Allstate typically uses the “17c formula,” which is known for undervaluing claims. Your appraisal becomes your strongest evidence when negotiating.

4. Submit Your Diminished Value Claim to Allstate

Once you have your appraisal and documents ready, contact Allstate through your adjuster, the Allstate claims portal, or their customer service line.

When you file the claim, let them know you’re requesting compensation for diminished value under the existing claim number.

Then submit your appraisal report and all supporting documentation, along with a short written explanation of why you’re requesting diminished value.

5. Work Through Allstate’s Review Process

After you submit your claim, Allstate will go through its internal review. They may inspect your vehicle again, analyze your repair documents, and run their own calculations.

They’ll eventually come back with an offer, but this first offer is often much lower than the actual loss in value.

This is where your appraisal and documentation become incredibly important.

6. Negotiate Until You Reach a Fair Settlement

Negotiation is a normal and expected part of the diminished value process. Compare Allstate’s offer with the numbers in your appraisal.

If the offer seems too low, ask the adjuster to explain how they calculated it, point out any inconsistencies, and use your appraisal to challenge their estimate.

Presenting comparable sales listings and repair details also helps influence the outcome.

Most claimants who push back respectfully end up receiving significantly higher settlements.

7. Escalate the Claim if You Still Don’t Get a Fair Offer

If Allstate still undervalues your claim, you have options. You can ask for a supervisor review, submit a complaint to your state’s Department of Insurance, or explore arbitration or small-claims court.

Some people even speak with a diminished value expert or attorney when the amount is large enough to justify it.

Often, simply escalating the claim makes Allstate reconsider its initial offer.

How Much Money Can You Get from an Allstate Diminished Value Claim?

There’s no fixed number because it depends on your car’s value, mileage, age, the type of damage, and the strength of your appraisal.

Most diminished value payouts fall somewhere between $1,000 and $8,000, although newer and luxury vehicles can qualify for much higher compensation.

The more evidence you provide, the more likely you are to receive a fair amount.

Ways to Maximize Your Allstate Diminished Value Claim

If you want the best payout possible, focus on building a strong case. A professional appraisal is your strongest tool. Make sure your photos, repair records, and vehicle history are organized and easy to understand.

Avoid accepting the first offer, because insurance companies almost always start low. Use comparable vehicle listings to show the true market value difference, and don’t be afraid to negotiate. Confidence and solid documentation go a long way.

Get a Professional Diminished Value Appraisal to Strengthen Your Allstate Claim

If you want the highest possible payout from Allstate, the most important step you can take is getting a certified diminished value appraisal.

Insurance companies rely on formulas that usually underestimate your loss, but a professional, evidence-backed appraisal gives you real leverage and dramatically increases your chances of a fair settlement.

If you need a trusted, accurate, and fast diminished value appraisal, My Fair Claim can help you prove the true loss in your vehicle’s value so you don’t leave money on the table.

Reach out today or call us 📞+1 877-503-3247. Get the expert support you need to win your diminished value claim with confidence.